Nextrade Group, November 2024

The Association of Southeast Asian Nations (ASEAN) economies have a strong offensive interest in digital services trade. This paper analyzes the regional economies’ digital services exports and their importance for GDP growth, job creation, and regional firms’ expansion. The main findings are as follows:

-

ASEAN economies have increased their digital services and goods exports significantly over the past decade, with digital services exports expanding to $269 billion or 50 percent of all commercial services exports in 2023, from 36 percent in 2009 (Figure 1). Digital services exports make up a particularly large share of commercial services exports in the Philippines, Singapore, Indonesia, and Thailand.

Figure 1: ASEAN digitally deliverables services exports and as share of global digitally deliverable services exports in 2009-23 (in millions of USD)

-

ASEAN has risen to become the world’s top-3 digital services exporter. ASEAN digital services exports made up 6.1 percent of global digital services exports in 2023, up from 3.6 percent in 2009, making the ASEAN region a top-3 exporter of digitally deliverable services in the world, only behind the United States and the UK, and right ahead of Germany and India (Figure 2). The integration of ASEAN region’s digital services in regional and global value chains has also deepened.

Figure 2: World’s top-10 digital services exporters in 2023 (in millions of USD)

-

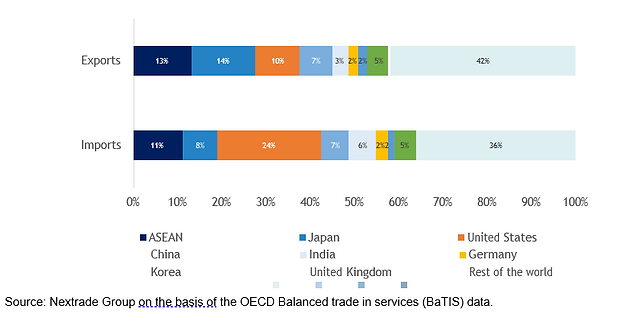

ASEAN intra-regional market is critical for ASEAN digital services exporters and has enabled ASEAN economies that are newer to digital trade to grow their digital services exports. In 2021, 13 percent of ASEAN digital services exports were destined for the intra-regional market, while 14 percent were exported to Japan, 10 percent to the United States, and 7 percent to China (Figure 3). Intraregional digital services exports have grown especially rapidly for economies that have not traditionally been strong digital services exporters, such as Vietnam, Cambodia, Myanmar, and Thailand.

Figure 3: Direction of ASEAN economies’ digital services exports in 2021 (in billions USD)

-

Digital services exports are an increasingly important part of ASEAN economic growth and job creation. Digital services exports were in 2023 about 7 percent of the ASEAN GDP, up from 4 percent in 2009. As the digital services sector continues to outpace services trade and economic growth, its importance will only expand. At current growth trajectories, digitally deliverable services exports could expand to 15.5 percent of ASEAN GDP in 2030. Digitally deliverable services employment tracks the share of digital services of GDPs. In ASEAN, digitally deliverable services sectors make up 7.9 million jobs, or 2 percent of all employment; Singapore, Brunei, and the Philippines have the highest shares of workers in digitally deliverable services sectors.

-

ASEAN’s strong expansion of digital services exports is due to a number of business and policy factors, such as the rise of millions of regional digital service providers, scalable digital startups, vibrant tech ecosystems, investments from leading technology companies in the region, an enabling environment for digital services trade, and the regional economies’ participation in digital trade and economy agreements.

-

ASEAN digital services exporters are highly export-driven, and especially small firms rely on the intraregional market. Some 87 percent of ASEAN micro and small and 95 percent of medium and large digital services providers export, and 27 percent of the micro and small and 45 percent of medium and large providers derive more than a quarter of their revenue from exports. The ASEAN market is especially important to micro and small digital services exporters, which use the intra-regional market as a springboard from which to grow and expand to other world markets.

-

ASEAN digital services exporters critically depend on imported services, highlighting the importance of permissive import policies for ASEAN digital service exporters’ success. ASEAN digital service providers’ import intensity rises with their export intensity: firms that derive a large share of their revenues from exports also make extensive use of imports, while most non-exporters do not import. Policies that enable digital services imports are thus essential for digital services export growth.

-

Digital trade opportunities have helped promote and expand through the formation of some 26,000 disruptive digital services startups in the ASEAN region over the past decade, and the establishment of over a hundred offices by the world’s top-30 technology companies in the region. ASEAN digital services startups across such industries as software, financial services, data analytics, edtech and fintech, and many more, are highly scalable and can promote regional exports further.

-

The Digital Economy Framework Agreement (DEFA) opens one important opportunity to expand ASEAN digital services exports further, and cement the ASEAN region as exporters’ power base. By expanding ASEAN economic intra-regional trade in digital services by as much as 42 percent starting about 2026, the DEFA could amplify the role of digital services in ASEAN economies even further, to 16.3 percent of ASEAN GDPs and 13.1 percent of global digital services exports.

-

The adoption of pro-digital trade policies by the ASEAN economies is also fueling digital exports, bridging intra-regional disparities in the adoption of policies through the DEFA could promote digital services trade further. A recent analysis by Nextrade Group for the USAID-backed eTrade Alliance of the adoption of 100 policies conducive to digital trade suggests that the more advanced ASEAN economies are well on the way to adopting pro-digital trade policies. The economies with the best adoption rates of good digital policies also have a high intensity of digital services exports in their economies. In economies such as Myanmar, Lao PDR, and Brunei, the DEFA could help accelerate the adoption of pro-digital trade policies in these economies.